留学生论文代写范例-中国国有银行与民营银行的绩效衡量。本文是一篇典型的留学生论文范文,是以report形式呈现,本论文的主要目的是讨论国有银行和私人银行之间的绩效。本研究将采用财务比率分析和数据包络分析(DEA)两种方法对选定的6家中国银行进行绩效评估,其中包括3家国有银行和3家典型的民营银行。我假设财务比率分析和DEA分析的结果将相互对应。然而,这两种方法都有其优缺点。结合这两种方法对6家中国银行的绩效进行分析,结果均表明,国有银行的绩效相对优于中国的民营银行。下面就一起来看一下这篇留学生论文的全部内容。

The main purpose of this report is to discuss the performance between state-owned banks and private banks. In my study, both financial ratio analysis and data enveloping analysis (DEA) will be used to evaluate the performance among selected 6 Chinese banks, which including 3 state-owned banks and 3 typical private banks. I assumed that both results from financial ratio analysis and DEA analysis will having the mutually corresponding to each other. However, both approaches have its own strengthen and weakness. To analyze the performance among 6 Chinese banks with combined of those two approaches, both results stated that the performances in state-owned banks are relatively better than private banks in China.

INTRODUCTION 引言

Background of China’s banking industry 中国银行业背景

Banking industry is one of the core industries of a nation’s economy. China has promoted the rapid development during sustained and steady economic growth and significant increase in national income. With an “open door” government policy, Chinese banking industry plays a key role on national economy; And many international investors are keeping an eye on the development in Chinese banking sector.

银行业是一个国家经济的核心产业之一。中国在经济持续稳定增长和国民收入显著增加的同时,促进了经济的快速发展。随着政府的“门户开放”,中国银行业在国民经济中发挥着关键作用;许多国际投资者正密切关注中国银行业的发展。

After People’s Republic of China (PRC) been founded in 1949 (Chaurasia et al., 2004), the Chinese banking system developed by 4 periods, and finally formed into the current system.

1949年中华人民共和国成立后,中国的银行体系经历了4个时期的发展,最终形成了现行体系。

The PRC’s banking system establishment from 1948 to 1953, during this period, the People’s Bank of China (PBOC) was established on December 1st, 1948. As a central bank, it was directly under the administration of the government of China and began to establish China’s national banking system and handle some economic issues.

1948年至1953年,中国银行体系建立。在此期间,中国人民银行于1948年12月1日成立。作为中央银行,它直接隶属于中国政府,开始建立中国的国家银行体系,并处理一些经济问题。

From 1953-1978, China moved into the centrally planned economy system. During this period, the PBOC, in one aspect, was not only exercising the financial authorities, such as to supply the China’s currency RMB and to formulate the monetary policy; In another aspect, the POBC was also operates all banking businesses in China.

从1953年到1978年,中国进入了中央计划经济体制。在此期间,中国人民银行不仅在一个方面行使金融权力,如供应中国货币人民币和制定货币政策;另一方面,中国人民银行还经营着中国的所有银行业务。

Since Reform and Opening up in 1978, China’s opened its domestic market to the global community, the banking industry in China began to carry out a huge reform. In February 1979, Agricultural Bank of China has resumed (www.gov.com., 2009), it breaks the financial system during the Planned Economy; In January 1984, the Industrial and Commercial Bank of China was founded (Forbes, 2019), the professional banking system was initially established in China. In July 1986, the first private commercial bank was founded.

自1978年改革开放以来,中国向国际社会开放了国内市场,中国银行业开始进行了巨大的改革。1979年2月,中国农业银行复牌,打破了计划经济时期的金融体制;1984年1月,中国工商银行成立,专业银行体系在中国初步建立。1986年7月,第一家私营商业银行成立。

In December 11, 2001, China joined into the World Trade Organization (WTO) and became the 143rd WTO member (www.wto.org., 2018), China’s banking industry takes more functions on China’s economic growth. For the better development of China’s economy, Chinese government has allowed a dozen private commercial banks and many city commercial banks to operate in China (KPMG, 2007). Also, foreign banks could set branches and to make investment in China. So far, the current Chinese banking sector has formed.

2001年12月11日,中国加入世界贸易组织(WTO),成为第143个WTO成员,中国银行业在中国经济增长中发挥着越来越大的作用。为了更好地发展中国经济,中国政府允许十几家私营商业银行和许多城市商业银行在中国经营)。此外,外资银行可以在中国设立分行和进行投资。目前,中国银行业已经形成。

As a part of China’s economic system, banking sector in China plays an important character in promoting economic development and further improving the investment and modern financial system. Since Reform and Opening up in 1978, with the rapid development of macro-economy and capital market in the past four decades, rapid development has achieved in the China’s banking industry.

作为中国经济体系的一部分,中国银行业在促进经济发展、进一步完善投资和现代金融体系方面发挥着重要作用。1978年改革开放以来,随着近四十年来宏观经济和资本市场的快速发展,我国银行业取得了快速发展。

1.2 State-owned banks and private banks in China 中国国有银行和私人银行

In Chinese banking sector, there are four big state-owned banks, which include Bank of China (BOC), Agricultural Bank of China (ABC), China Construction Bank (CCB), and Industrial and Commercial Bank of China (ICBC), proved as important character in the domestic development. Those four state-owned banks in China, involved not only in the domestic infrastructure construction financial services, but also operations in the offshore financial businesses, have played an important role in China’s rapid development since Reform and Opening up in 1978.

在中国银行业,有四大国有银行,包括中国银行(BOC)、中国农业银行(ABC)、中国建设银行(CCB)和中国工商银行(ICBC),被证明是国内发展的重要特征。这四家中国国有银行不仅从事国内基础设施建设金融服务,还经营离岸金融业务,为1978年改革开放以来中国的快速发展发挥了重要作用。

After 1984, since the “open door” government policy, China began privatization and commercial development in China’s banking industry. In July 1986, the first private commercial bank was founded and followed by some others such as China CITIC Bank, China Minsheng Bank, and Ping An Bank. These private banks not only share the banking businesses from state-owned banks, but also enrich the banking operations and drive the private financial services. However, in this paper, my study is only focusing on the performance analysis between the state-owned banks and private banks in China. 3 of state-owned banks, which including Agricultural Bank of China (ABC), China Construction Bank (CCB) and Industrial and Commercial Bank of China (ICBC); 3 typical private banks, which including China CITIC Bank, Ping An Bank and China Minsheng Bank; are selected to investigate their operations and efficiencies in 2018.

1984年以后,自政府实行“门户开放”政策以来,中国开始了银行业的私有化和商业化发展。1986年7月,中国第一家民营商业银行成立,随后是中信银行、中国民生银行和平安银行。这些民营银行不仅分享了国有银行的银行业务,而且丰富了银行业务,带动了民营金融服务。然而,在本文中,我的研究仅侧重于国有银行和民营银行之间的绩效分析。3家国有银行,包括中国农业银行(ABC)、中国建设银行(CCB)和中国工商银行(ICBC);3家典型的民营银行,包括中信银行、平安银行和中国民生银行;被选中调查其2018年的运营和效率。

1.3 Summary 总结

In this section, it stated the background of Chinese banking sector, and shown the history and development between state-owned banks and private bank in Chinese banking section. The next section will be focused on the literature reviews, many of previous studies shown that performance analysis is feasible and reliable by using financial ratios and DEA output oriented VRS approach. The section 3 will be focused on the data and methods; in this section, the variables in 6 banks are collected from their annual reports, which including return on average assets (ROAA), return on average equity (ROAE), net interest margin (NIM), and capital adequacy ratio (CAR); the DEA output oriented VRS approach and financial ratios analysis will be combined to investigate the performance in those 6 banks since the two approaches have its own strengthen and weakness. The section 4 will be emphasized on the results, it presents the overall efficiencies among 6 banks by using DEA output oriented VRS approach and financial ratio analysis. In the section 5, the concluding remarks and future perspective will be provided at the end.

在这一部分中,阐述了中国银行业的背景,并展示了中国银行业国有银行和私人银行之间的历史和发展。下一节将集中于文献综述,之前的许多研究表明,使用财务比率和DEA输出导向VRS方法进行绩效分析是可行和可靠的。第3节将重点介绍数据和方法;本节从6家银行的年报中收集变量,包括平均资产回报率(ROAA)、平均权益回报率(ROAE)、净息差(NIM)和资本充足率(CAR);由于这两种方法各有优缺点,因此将DEA面向产出的VRS方法和财务比率分析相结合来调查这6家银行的绩效。第4节将重点介绍结果,它使用DEA输出导向VRS方法和财务比率分析展示了6家银行的整体效率。在第5节中,最后将提供结论和未来展望。

REVIEW OF THE RELEVANT LITERATURE 相关文献综述

2.1 Introduction 引言

In this section, literature reviews are relating to banking performance analysis studies by using financial ratios, and banking efficiency studies and approaches for investigating banking operations. The banking performance analysis draws many attentions in the recent years, most of domestic and foreign investors are interested in accurate measurement in banking sector, and finally benefit for their decision-making.

Based on the previous studies, most of the empirical studies are emphasize on the performance analysis by using DEA model and some of financial ratios approach. In one aspect, traditionally methods to analyze the banking performance are usually based on the financial ratios (Ncube, M., 2009). For example, Samad and Hassan (1999), by using financial ratios analysis, demonstrate that the reason for slow development of loans is lack of knowledge. In another aspect, Matthews, K. (2013) believed that the efficiency in Chinese banks by using DEA approach is reliable and showed less errors. X. Chen, M. Skully, K. Brown (2005) noticed that the numerical value in banking efficiency could be accurate analysis by using DEA approach. Y. Chen, W.D. Cook, N. Li, J. Zhu. (2009) find that with the development of DEA methods, the two-stage DEA approach would be more precise than the previous DEA approach. However, some of scholars combined those two approaches, which called “DEA in conjunction with financial ratio”, are attempted to create a better way of banking performance evaluation to the international investors (Yeh, Q., J., 1996).

2.2 Financial ratios 财务比率

Financial ratios are being used to explain the activities in economy. People in the worldwide have been using financial ratios for a long time. Even though some scholars believed that the method is not accurate in economic analysis, this method is a simple way to comparison, and provide a quick way to predict the economic activities in their daily life (Horrigan, J., 1968). In banking sector, the financial ratios are used to describe the performance among banks. For example, people usually determining the capacity of profitability by counting return on average assets (ROAA), return on average equity (ROAE) and net interest margin (NIM); To determine the risks in the bank, people always counting the Non-performing loans ratios (NPLs); And to analyze the capacity of resilience in the bank, the capital adequacy ratios (CAR) would be the better way. In an empirical study, to predict the possibility of bankruptcy, Ohlson, J. (1980) was using financial ratios to find some evidences to prove that financial ratios analysis is a reliable approach in banking sector analysis. However, the financial ratios analysis has its own weaknesses. The financial ratios analysis is only available in some specific items, such as profitability ratio or capital adequacy ratio; it cannot run into the overall comparison and analysis, the results could send wrong messages to decision makers.

2.3 DEA output oriented VRS model 面向DEA输出的VRS模型

Nowadays, a technique has been developed that can be used to estimate the efficiency by using inputs and outputs. This technique is called Data Enveloping analysis (DEA). In 1978, DEA approach and its models were created by A. Charnes and W.W. Cooper in Canada (Charnes, et al., 1978). With development for decades, DEA approach has shown its unique advantages in estimate relative efficiencies by dealing with multiple inputs and multiple outputs. The DEA approach could transform the multiple inputs and multiple outputs without conversion the units of data. DEA approach is a reliable method that has been widely applied in operational research and statistical science. DEA methods is a quantitative analysis that used to evaluate the relative efficiency of comparable units, such like banking sector, according to the multiple inputs and multiple outputs.

The DEA approach can be set for 3 stages. First, assumed units in some comparable products or services in similar area; Second, assume that all units can be used within the similar ranges; Third, since the external environment units would affect the overall performance, the units that assumed would operate in a similar area (Dyson et al., 2001). DEA approach also able to set the benchmark of decision-making units (DMUs), or it could be considered as efficient frontier, are used to comparison each other.

Many empirical studies have measured the overall efficiency in Chinese banking sector by using some of traditional approaches, such as financial ratios analysis (Said et al. 2011). However, some scholars have measured the banking performance by using DEA approach, even by using advanced two-stage DEA method (Simar et al. 2007), the results shown that since more accurate and less errors than by using traditional approaches, the DEA approach used in Chinese banking sector is a better choice in banking performance analysis.

Based on the DEA method, there are many different models to measure the efficiency in a similar area, the VRS model is the one that mostly recommended for banking performance analysis. In this paper, the DEA output oriented VRS model will be used to measure the efficiency between state-owned banks and private banks in Chinese banking sector. However, the DEA approach has its own weaknesses, it is not only sensitive if there are outliers or measurement errors existed, and also not comprehensive to evaluate all aspects of banking operations because of limited data.

2.4 Summary 总结

In this section, there are two approaches widely used in banking performance analysis, that are: financial ratios analysis and data enveloping analysis. According to the relevant literature, some of empirical studies demonstrate that those two approaches are reliable; In one aspect, financial ratios analysis is used to analyze some specific items. For example, return on average assets (ROAA), return on average equity (ROAE) and net interest margin (NIM) are used to evaluate the capacity of profitability in banks; Non-performing loans ratios (NPLs) could be estimate the bank risks; capital adequacy ratios (CAR) could be considered as the level of risk-resistance of banks. In another aspect, DEA approach is used to evaluate the overall performance in banking sector. DEA approach also able to set the benchmark of decision-making units (DMUs) that used to comparison each other in similar sector. Different from financial ratios, DEA approach in banking performance analysis is based on the objective data without biased, it also transforms the multiple inputs and multiple outputs without conversion the units of data. DEA approach combined with financial ratios analysis to evaluate the overall performance in the banking sector would makes more accurate and less errors in final result.

In next section, data analysis will be occurred among 6 Chinese banks. First of all, the data from annual report will be first into financial ratios analysis, the analysis will be focus on the profitability, risk level, and risk-resistance among those banks. Then, based on the data from the annual reports from 6 Chinese banks, both DEA approach and financial ratios analysis will be used to evaluate the individual items and overall efficiency.

DATA AND METHODOLOGY 数据和方法

Introduction 引言

As same as all enterprises, banks issue its own annual report on every year. In annual report, banks released many its own information to the publics, such as shareholders and other investors, about its annual business activities and its financial situation. Based on the annual report, people will have some specific information they need. In this paper, some financial ratios are needed to analyze. From annual report of the 6 Chinese banks, financial ratios would come from a part of the financial statements. Many of the financial ratios could be find at the consolidated income statement and consolidated balance sheet. DEA approach is established on the multiple inputs and multiple outputs. Thus, the DEA approach could be run at those financial ratios after its been collected.

3.2 Variables in Financial Ratios 财务比率变量

In this paper, profitability ratios, non-performing ratio and capital adequacy ratio are used to complete my financial ratio analysis. Since that, the data have to find on consolidated income statement and consolidated balance sheet that all coming from annual reports of the 6 Chinese banks (Annual Report, 2018).

Profitability ratios (see Appendix A) in banking sector shows how many returns from its investing and lending. The return on average assets (ROAA), return on average equity (ROAE) and net interest margin (NIM) are used to run the profitability analysis. Based on that, higher value on ROAA, ROAE and NIM refer the better profitability in banking sector. Non-performing loan (see Appendix A, A1) is the loan that close to default or even in default. The non-performing loan ratio refers that how many non-performing loans are over the total loans. Based on that, the NPLs, in other words, shows the risk level of a bank, the lower value in NPLs refers better management in loans, or lower risk among banking sector. Capital Adequacy ratio (see Appendix A, A1) refers a bank’s available capital could be use, the higher value shows more available capital than other banks, or better capacity of risk-resistance.

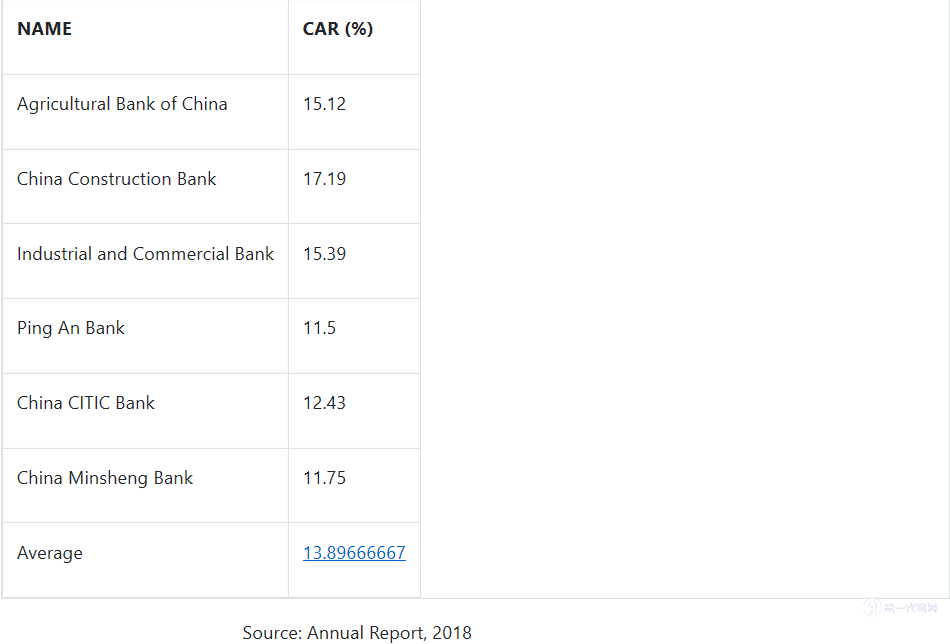

Table 1. Profitability Ratios

The profitability ratios (see Table 1.) are calculated by the return on average assets (ROAA), return on average equity (ROAE) and net interest margin (NIM), all the data are coming from the annual report of 6 Chinese banks (Annual Report, 2018), the table shows the differences in profitability between state-owned banks and private banks in China.

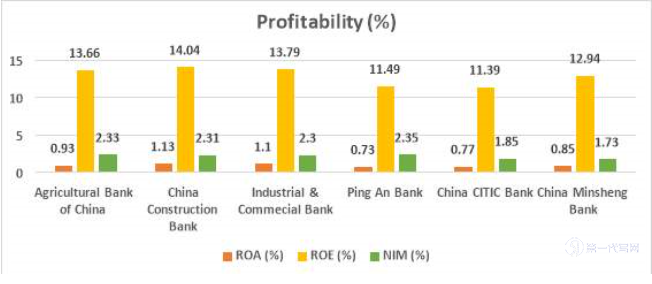

Table 2. Non-performing Ratio

The non-performing ratio (see Table 2.) is calculated by non-performing loans over total loans (see Appendix A, A1). All the data are coming from the annual report of 6 Chinese banks (Annual Report, 2018).

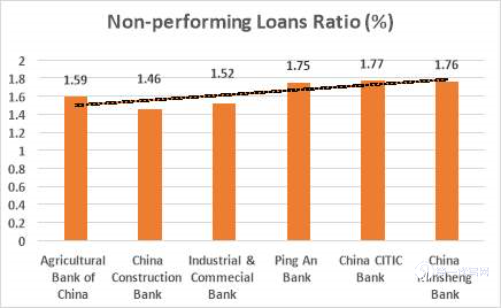

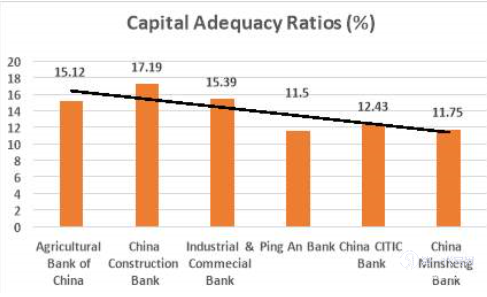

Table 3. Capital Adequacy Ratio

The capital adequacy ratio (see Table 3.) is refers the total equity to risk-weighted assets ratio (see Appendix A, A1). All the data are coming from the annual report of 6 Chinese banks (Annual Report, 2018).

3.3 Data Enveloping Analysis (DEA) Approach 数据包络分析方法

The data enveloping analysis (DEA) is widely be used to evaluate the relative efficiencies among in a sector, it shows a unique strengthen in evaluate relative efficiencies of multiple inputs and multiple outputs. The DEA approach is a better choice to estimate the efficiencies since its based on the objective data without any subjective data been used. Thus, the result would be more accurate and less in errors. According to the financial ratio section listed above, the data are enough to run the DEA output oriented VRS model. Based on the theory of this method, the return on average assets (ROAA), return on average equity (ROAE), net interest margin (NIM) and capital adequacy ratio (CAR) are considered as outputs.

In this paper, the variables of output are selected based on the DEA output oriented VRS model. Each output represents the different definition in method, it could be described as:

Return on average assets (ROAA) is the ratio that shows how many returns from its assets (see Appendix A, A2). It refers the capacity of earning by using its assets. Higher the ROAA, more returns could generate from its assets.

Return on average equity (ROAE) is the ratio that shows how many returns generate from its equity (see Appendix A, A2). It refers the level of earning capacity the banks could handle from its shareholders. Higher the ROAE, more income and growth could generate from its equity.

Net interest margin (NIM) is the ratio that shows how many interest incomes generate from its loans (see Appendix A, A2). It refers the earning that generate from interest paid out to its lenders. Higher the NIM, more incomes that paid out from its lenders.

Capital adequacy ratio (CAR) is the ratio that shows how many available capitals the bank could use (see Appendix A, A2). It refers the percentage of available capital divided by banks risk-weighted assets. Higher the CAR, more available capital the bank could use, and the capacity of risk resistance is higher.

Those variables of output could be described as observed output. The next step is to set an inefficient decision-making unit (DMU), or it could be considered as output target, the efficiency is the ratio of output target over observed output. According to the DEA method, we have to evaluate the slack between output target over observed output, the slack refers how much the bank have to growth if the inefficient bank wants to be efficient.

3.4 Summary 总结

In this section, based on the annual reports from the 6 Chinese banks, I have already established the data by collection and organization. In this paper, first of all, I attempt to use financial ratio analysis to describe the banking performance in three aspect, that are: profitability, risk level, and the capacity of risk resistance. The return on average assets (ROAA), return on average equity (ROAE) and net interest margin (NIM) are the good way to describe the earning capacity in the 6 Chinese banks; The non-performing loans indicate the risk the banks have; the capital adequacy ratio could better understand the which bank has its relative better capacity of anti-risk in banking sector. Then, I am attempting to evaluate the relative banking efficiency among the 6 Chinese banks by using DEA output oriented VRS model, this approach is using outputs to estimate the relative efficiency among banks. Based on the methods, the return on average assets (ROAA), return on average equity (ROAE), net interest margin (NIM) and capital adequacy ratio (CAR) are considered as outputs. Up to now, the DEA approach is a better choice to evaluate the relative efficiency among sector, and it has also indicated a unique strengthen since its all based on the objective data but not biased or subjective opinions.

In next section, I am attempting to run some of financial ratio analysis by using profitability ratio, non-performing ratio and capital adequacy ratio; the result would show the relative performance among the 6 Chinese banks. Afterwards, I will run the DEA approach to evaluate the relative efficiency among banks. The date from financial ratio would be considered as variables of output, such as return on average assets (ROAA), return on average equity (ROAE) and capital adequacy ratio (CAR) will be used in method.

RESULTS AND ANALYSIS 结果和分析

4.1 Introduction 引言

In this section, the financial ratio analysis and DEA analysis will be occurred on the 6 Chinese banks. According to the result, it is going to indicate the performance between state-owned banks and private banks among Chinese banking sector in 2018. Some empirical studies show that the state-owned banks in China have better performance than private bank since the adequate capital supply and strong support from Chinese government (Tan, Y. 2016). Thus, I have to use financial ratios analysis and DEA analysis among the 6 Chinese banks to evaluate the performance between state-owned banks and private banks in China. In financial ratio analysis, I am going to analysis the performance among the 6 Chinese banks in 3 aspects: profitability, risk, and capacity of risk resistance. In DEA analysis, the outputs from the variable in financial ratios are used to evaluate the relative efficiency among the 6 Chinese banks, and the result would be considered as the quality of banking performance among banks.

4.2 Financial Ratio Analysis 财务比率分析

Financial ratios are the tools that widely used to analyze the performance of a business entity. In this paper, financial ratios are a simple and quick ways to estimate the profitability, risks and capacity of risk resistance among banks. By using financial ratios, banks could have easily compared each other by different items, such as financial situations. The financial ratios are follows:

Fig. 1. Profitability ratios

According to the chart of profitability ratios (see Fig 1.), there are two return ratios and one margin ratio on the chart. For return on average assets (ROAA), the value of ROAA in state-owned banks, which including Agricultural Bank of China (ABC), China Construction Bank (CCB) and Industrial and Commercial Bank of China (ICBC), are higher than the selected private banks, which including China CITIC Bank, Ping An Bank and China Minsheng Bank. Based on the calculation, the average value of ROAA is 0.918 (see Table 1.), it is obvious that all of the private banks are below the average value. The result stated that the state-owned banks have better incomes than the private banks from the same proportion of assets.

For return on average equity (ROAE), the value of ROAE in state-owned banks are higher than the private banks. Based on the calculation, the average value of ROAE is 12.885 (see Table 1.), the value of ROAE in all state-owned banks are above the average value. The ROAE value in China Minsheng Bank is the only private banks that above the average value among private banks, it can only indicate that China Minsheng Bank has better earnings on equity among private banks. The result stated that the state-owned banks have better incomes than the private banks from the same proportion of equity.

For net interest margin (NIM), the value of NIM in stated-owned banks are higher than the private banks except Ping An Bank. Based on the calculation, the average value of NIM is 2.145 (see Table 1.), the value of NIM in all state-owned banks are above the average value. The NIM value in Ping An Bank is higher than other private banks, even higher than the state-owned banks, it indicates that Ping An Bank not only earned more interest from loans, but also good at management and control in loans among 6 banks. The result stated that the state-owned banks have better earnings than the private banks from the same proportion of loans.

In conclusion, according to return on average assets ratio, the value of ROAA in state-owned banks are higher than private banks, the result stated that the state-owned banks have better returns than the private banks at the same proportion of assets; In return on average equity ratio, the value of ROAE in state-owned banks are higher than the private banks, the result stated that the state-owned banks are good at capacity of income than the private banks from same proportion of equity; In net margin ratio, the value of NIM in stated-owned banks are higher than the private banks except Ping An Bank., the Ping An Bank has better capacity of earning and risk-control than other banks, but the state-owned banks have better earnings than the private banks from the same proportion of loans in overall.

Fig. 2. Non-performing Loans Ratio

According to the chart of non-performing loans ratio (see Fig 2.), the value of NPLs in state-owned banks are lower than the private banks. Based on calculation, the average value of NPLs is 1.6416 (see Table 2.), the value of NPLs in state-owned banks are below the average value. The result indicates that the banking risk in state-owned banks are lower the private banks, in other words, banking risk management and control in state-owned banks are better than the private banks in China.

Fig. 3. Capital Adequacy Ratio

According to the chart of capital adequacy ratio (see Fig 3.), the value of CAR in state-owned banks are higher than the private banks. Based on calculation, the average value of CAR is 13.897 (see Table 3.), the value of CAR in state-owned banks are above the average value. The result indicates that the available capitals in state-owned banks are more adequate than the private banks. That is, state-owned banks not only have stronger capacity to resist banking risks than private banks, but also have better ability to protect depositors than private banks in Chinese banking sector.

4.3 DEA Analysis DEA分析

Based on the financial ratio analysis above, we have some variables of financial ratio that could be considered as the variables of output in DEA approach. DEA methods is a quantitative analysis that used to evaluate the relative efficiency of comparable units of inputs and outputs. According to the methods, the return on average assets (ROAA), return on average equity (ROAE), net interest margin (NIM) and capital adequacy ratio (CAR) are considered as outputs (see Table 1.). The variables of output are going to considered as observed outputs.

Based on DEA method, an inefficient decision-making unit (DMU) have to be assumed, it also could be considered as output target. The efficiency is the percentage of output target on observed output. The slack between output target over observed output could be considered as how much the bank have to growth if the inefficient bank wants to be efficient. After the calculation, the result is follows:

Table 4. Efficiency among the 6 banks

The Table 4 stated the relative efficiencies among 6 Chinese banks, the 100% efficiency to a bank could be identified as an efficient bank; an inefficient bank is identified as the efficiency score is less than 100%. According to the value of efficiency, the result shows that the value of efficiency in state-owned banks are still better than the private banks. The Ping An Bank could be considered as an efficient bank since its net interest margin is the best one among the 3 private banks (see Table 1.), the higher score in NIM indicates the Ping An Bank has better earning capacity and management in loans than other banks. But the other two private banks, which including China CITIC Bank and China Minsheng Bank, have lower efficiency scores are far away from the average value (see Table 4.). Now, we are going to briefly investigate the differences among banks, the result is follows:

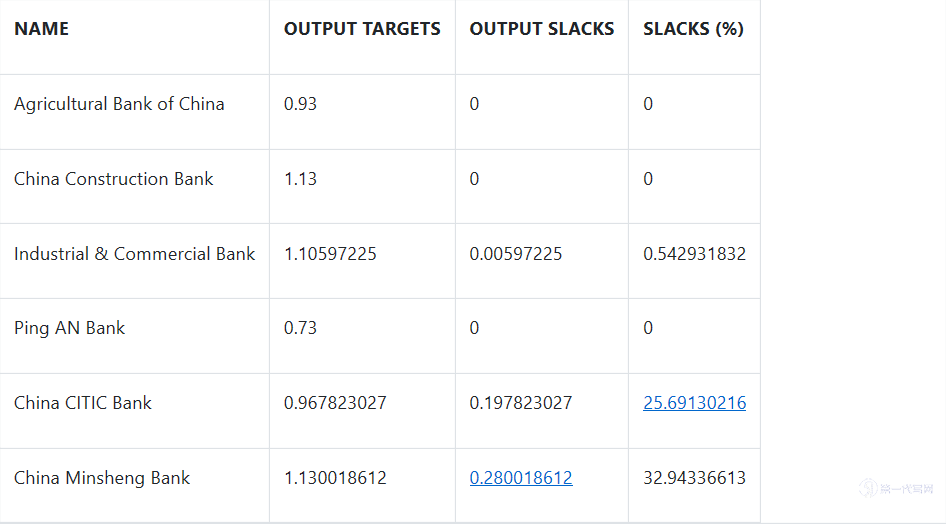

Table 5. Slacks

Based on the result, three banks, ABC, CCB and Ping An Bank are considered as efficient banks (see Table 5.), the other banks are inefficient banks. The slack is the differences between output target and observed output, it also could be considered as how much the bank have to growth if the inefficient bank wants to be efficient. Based on the DEA method, the result stated that if Industrial and Commercial Bank wants to be efficient, its output should increase by 0.00597 or 0.543%; if China CITIC Bank wants to be efficient, its output should increase by 0.1978 or 25.7%; if China Minsheng Bank wants to be efficient, its output should increase by 0.28 or 32.94%.

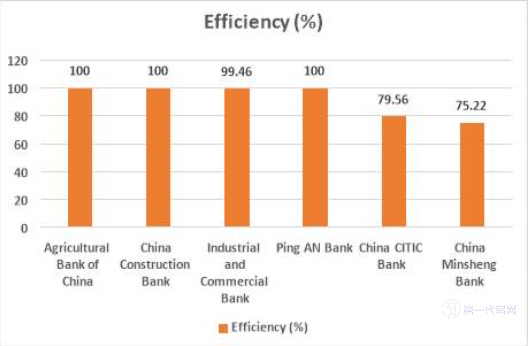

In conclusion, the overall efficiency among 6 Chinese banks by using DEA approach, the result stated that the state-owned banks have higher relative efficiency than the private banks (see Fig. 4.). Based on the DEA analysis, in one aspect, the state-owned banks have stronger earning capacity and more adequate available capital than the private banks; in another aspect, the state-owned banks are also better in capacity of risk resilience than the private banks. The chart shows the relative efficiency among the 6 Chinese banks:

Fig. 4. Efficiency

4.4 Summary 总结

In this section, the financial ratio analysis is used to investigate the profitability, banking risk, and risk resilience among the 6 banks. The relative efficiency among banks is evaluated by using DEA method. Profitability ratios, non-performing ratio and capital adequacy ratio are used to complete the financial ratio analysis in this paper.

The profitability ratio in my study is separate into three ratio analysis, that are: return on assets ratio, return on equity ratio and net interest margin ratio. In return on assets ratio, the state-owned banks with higher value of ROAA are have better incomes than the private banks from the same proportion of assets. In return on equity ratio, the state-owned banks with higher value of ROAE are have better earnings than the private banks from the same proportion of equity. In net interest margin ratio, the state-owned banks with higher value of NIM are have better earnings than the private banks from the same proportion of loans, but the Ping An Bank is an exception, with highest score in NIM, the Ping An Bank has better loans management than other banks. For non-performing loans ratio, the state-owned banks with lower value of NPLs are have lower banking risks than the private banks. For capital adequacy ratio, the state-owned banks with higher value of CAR are have more available capital than the private banks.

In DEA analysis, the Agricultural Bank of China, China Construction Bank and Ping An Bank could be considered as efficient banks since their relative efficient are 100%. Based on the DEA method, the result stated that Industrial and Commercial Bank have to increase its output by 0.543% to be an efficient bank; China CITIC Bank have to increase its output by 25.7% to be an efficient bank; China Minsheng Bank have to increase its output by 32.94% to be an efficient bank. The result indicates the relative efficiency in state-owned banks are higher than the private banks.

In conclusion, the results from both financial ratio analysis and DEA analysis are mutually corresponded. Those two analyses are having the similar answer that the state-owned banks are better in earning capacity, risk resilience and relative efficiency than the private banks. In next section, the conclusion remarks and future perspective are providing.

CONCLUSIONS 结论

5.1 Conclusion remarks 结束语

The main objective in this paper is to evaluate the relative performance between state-owned banks and private banks in China. Financial ratio analysis and data enveloping analysis are selected to measure the profitability, banking risks, capacity of risk resilience and relative efficiency between state-owned banks and private banks. In this paper, there are 6 banks in my study sample, which covers 3 state-owned banks (Agricultural Bank of China, China Construction Bank and Industrial and Commercial Bank of China), and 3 typical private banks (China CITIC Bank, Ping An Bank and China Minsheng Bank). I assumed that the results from both financial ratio analysis and data enveloping analysis are mutually corresponding to each other. In financial ratio analysis, by analyze the ratios from ROAA, ROAE, NIM, NPLs and CAR, the result stated that the state-owned banks have stronger earning capacity than private banks; And, with more adequate available capital, state-owned banks not only have good capacity to resist banking risks, but also have better ability to protect depositors than private banks in China. According to the DEA analysis, the result stated that the state-owned banks have better efficiency than private banks. Both results from financial ratio analysis and DEA analysis are mutually corresponding to each other. The overall performance in state-owned banks are better than private banks in China. My study indicates that both approaches are feasible and reliable in performance analysis, and also could reinforce and complement each other. However, both approaches have its own weakness. Financial ratio analysis is focus on analyze individual items, some of useful information is likely to be ignored by decision-makers. DEA method is good at comprehensive analysis, but it is sensitive to any outliers or small errors in data.

5.2 Future perspective 未来展望

After Reform and Opening Up in 1978, With an “open door” government policy, China’s economy has started its rapid development for decades. China in nowadays has become the second largest economic entity in the world. Investors around the world are keep an eye on China and looking for more opportunities that may benefit from the development in China’s financial market. Chinese banks play an important character on China’s economic growth. State-owned banks account for a large share in China’s banking sector; private banks, with rapid growth, enriched the banking operations and drive the private financial services in China. However, as a developing country, China’s government provide some fiscal policies toward state-owned banks, it makes unfair competition in Chinese banking sector. In my perspective, I suggest that invest state-owned banks should be a better option to investors, because state-owned banks are more efficient and stable in Chinese banking sector.

REFERENCES 参考文献

[1] Chaurasia, Radhey Shyam (2004). History of Modern China, New Delhi: Atlantic, p. 1, ISBN 978-81-269-0315-3

[2] “Agricultural Bank of China becomes shareholding company”

[3] “The World’s Biggest Public Companies List – Forbes”. Retrieved 2019-04-11.

[4] “WTO | Accessions: China”

[5] “China’s city commercial banks : Opportunity knocks?” (PDF). Kpmg.com.cn. Retrieved March 2007.

[6] Ncube, M. (2009). Efficiency of the Banking Sector in South Africa, African Economic Conference 2009 Fostering Development in an Era of Financialand Economic Crises, Addis Ababa.

[7] Samad, A., and M. K. Hassan (1999). “The Performance of Malaysian Islamic Bank During 1984-1997: An Exploratory Study”, International Journal of Islamic Financial Services, 1(3), 1-14.

[8] Matthews, K. (2013). Risk management and managerial efficiency in Chinese banks: a network DEA framework, Omega, 41, pp. 207-215

[9] X. Chen, M. Skully, K. Brown (2005). Banking efficiency in China: application of DEA to pre-and post-deregulation eras: 1993-2000, China Economic Review, 16, pp. 229-245

[10] Y. Chen, W.D. Cook, N. Li, J. Zhu. (2009). Additive efficiency decomposition in two-stage DEA, European Journal of Operational Research, 196, pp. 1170-1176

[11] Yeh, Q., J. (1996). The Application of Data Envelopment Analysis in Conjunction with Financial Ratios for Bank Performance Evaluation. Journal of the Operational Research Society, 47, pp 980-988.

[12] Horrigan, J. (1968). A Short History of Financial Ratio Analysis. The Accounting Review, 43(2), 284-294.

[13] Ohlson, J. (1980). Financial Ratios and the Probabilistic Prediction of Bankruptcy. Journal of Accounting Research, 18(1), 109-131. doi:10.2307/2490395

[14] Charnes, A., Cooper, W.W. and E. Rhodes (1978). “Measuring the Efficiency of Decision-Making Units,” European Journal of Operations Research, Vol. 2, pp. 429–444.

[15] Dyson, R.G., Allen, R., Camanho, A.S., Podinovski, V.V., Sarrico, C.S., Shale, E.A.. Pitfalls and protocols in DEA, European Journal of Operational Research, 2001, Vol.132(2), pp.245-259.

[16] Simar, L., and Wilson, P. W. (2007). Estimation and inference in two-stage, semi-parametric models of production processes, Journal of Econometrics, 136(1), pp. 31–64. 10.1016/j.jeconom.2005.07.009

[17] Said, R. M., & Tumin, M. H. (2011). Performance and financial ratios of commercial banks in Malaysia and China. International Review of Business Research Papers, 7(2), 157-169.

[18] Annual Report (2018) ICBC annual report. pp. 7 (online)

[19] Annual Report (2018) Agricultural Bank of China annual report. pp.

[20] Annual Report (2018) China Construction Bank annual report. pp. 9-10 (online)

[21] Annual Report (2018) China CITIC Bank annual report. pp. 21-23 (online)

[22] Annual Report (2018) China Minsheng Bank annual report. pp. 17 (online)

[23] Annual Report (2018) Ping An Bank annual report. pp. 10-12 (online)

[24] Tan, Y. (2016), “The impacts of risk and competition on bank profitability in China,” Journal of International Financial Markets, Institutions and Money, Vol. 40, pp. 85-110

留学生论文的主要目的是评估中国国有银行和民营银行之间的相对绩效。选择财务比率分析和数据包络分析来衡量国有银行和民营银行之间的盈利能力、银行风险、风险抵御能力和相对效率。本文研究样本中有6家银行,包括3家国有银行(中国农业银行、中国建设银行和中国工商银行)和3家典型的民营银行(中信银行、平安银行和中国民生银行)。作者假设财务比率分析和数据包络分析的结果相互对应。在财务比率分析中,通过对ROAA、ROAE、NIM、不良贷款和CAR的比率分析,结果表明,国有银行的盈利能力强于民营银行;而且,与中国的私人银行相比,国有银行拥有更充足的可用资本,不仅具有良好的抵御银行风险的能力,而且具有更好的保护储户的能力。DEA分析结果表明,国有银行的效率高于民营银行。财务比率分析和DEA分析的结果相互对应。国有银行的整体表现优于中国的民营银行。本篇留学生论文作者的研究表明,这两种方法在性能分析中是可行和可靠的,并且可以相互补充和补充。然而,这两种方法都有其自身的缺点。财务比率分析侧重于分析单个项目,一些有用的信息很可能被决策者忽视。DEA方法擅长于综合分析,但对数据中的任何异常值或小误差都很敏感。本站提供各国各专业留学生论文写作指导服务,如有需要可咨询本平台。