本文是一篇企业管理博士论文,本研究认为公司董事会结构与破产风险之间以及公司成长与破产风险之间的联系是由管理层做出的杠杆决策介导的,并由公司董事会进行监控,这是在代理理论背景下经常讨论的监控假设所解释的。

CHAPTER 1 INTRODUCTION

1.1 Research Background and Significance

1.1.1 Research Background

Firm failure is an epic topic in corporate finance literature. A persistent rise in insolvency risk eventually leads to business failure. Insolvency is a situation where a firm is unable to pay its financial obligations. A financially distressed firm is on the verge of default if not appropriately managed. It can be narrated that the firm's incapacity to meet its financial compulsions causes default (Hussain et al., 2020). Risk-taking activities can also promote long-term business growth (Faccio, Marchica, & Mura, 2011), but taking undue risks can be detrimental to businesses. The financial crisis periods, such as the 1997-1998 Asian financial crisis and the 2007-2008 credit crisis, advocate that companies are too risky to manage their businesses. Extreme risk-seeking behaviour can make financial stability worse and hamper economic growth. Business health is waning in today's global market (IMF, 2016). Corporate risk-taking has been intensified, and organizations should be strengthened to face the rising debt, severe credit conditions, and a slowing global economy. Risk management is considered an essential part of the corporate governance system (Santomil & González, 2020). The continuous relapse of widespread corporate failures vindicated the institutionalization of risk administration (Hubbard, 2020). It is believed that good corporate governance, adequate procedures to dodge costly mistakes, and proper risk control measures are essential for organizational success.

A business strategy must be grounded on superior risk assessment. Strategy and risk are closely linked since the risk affects the financial and the non-financial indicators (Smart et al., 2015). The risk is usually associated with bad news for companies, and the management is forced to clench bad news to limit financial jolts (Elshandidy & Shrives, 2016). Choosing the right debt/equity structure and debt maturity structure can frequently be considered a strategic choice. When a company makes a business decision, it is essential to base it on business strategy (Jabeen, Faisal, Al Matroushi, & Farouk, 2019). In this perspective, the choice of the leverage structure is a strategic decision that influences corporate financial performance. A healthier business strategy will provide companies with more opportunities to manage risk-related information, and therefore it will be more probable to divulge risk information (Fraser, Bat-Erdene, & Kunz, 2020).

1.2 Problem Statement

The business sector is the backbone of the economy and the main driver of economic growth for all countries, especially in developing countries like Pakistan. In a country where there is no dynamic corporate sector, it is difficult to obtain rapid economic progress and a sustained gross domestic product (GDP). In the corporate area, growth increases the production of goods and services and plays a crucial role in creating jobs. It also helps to attract foreign investments, increase exports and provide a favourable balance of payments. Increased employment and the greater availability of goods and services will positively impact income and ultimately help manage inflation and increase per capita incomes. The data available in many OECD countries show a dramatic increase in the number of bankruptcies and job losses in recent years. The OECD has recognized this problem and prepared a strategic response to the crisis, focusing on priority areas such as finance, competition, and governance, to ensure sustainable growth. Recently, the number of sick industrial companies in Pakistan has increased considerably due to many fold reasons. The business unit is considered ill due to poor financial performance and vulnerable position, and it worsens from year to year. It refers to persistent losses, and its capital reserves may decline over time. An entity cannot fulfil its obligations because its current liabilities exceed current assets. The growing trend towards business failures of all types, including the SMEs and large industrial sectors, is a source of great concern. This problem has been gaining weight and can have severe consequences and further implications for the economy of a country like Pakistan, which cannot generate employment and faces a decline in productivity. One of the main reasons for business failure is the inadequate financial management systems prevailed by such organizations. An entity with a higher leverage level than those that can be easily managed has difficulty controlling the debt payment schedules and face problems in servicing the debt due to high associated costs.

CHAPTER 2 LITERATURE REVIEW AND RELATED THEORIES

2.1 Literature Review

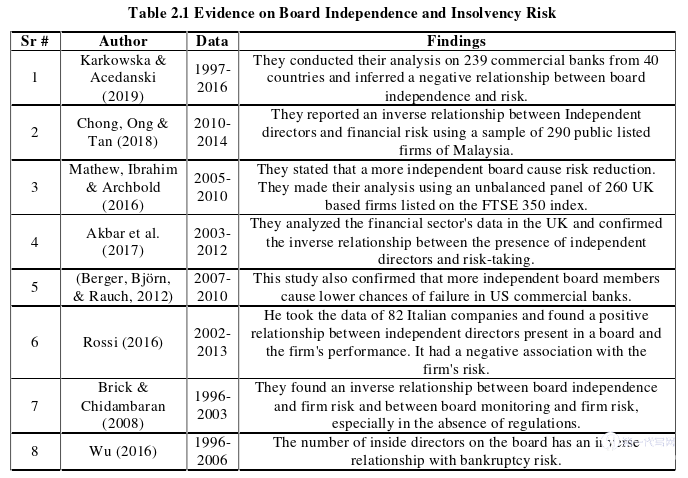

The corporate board structure combines three essential attributes of the board of directors: board independence, the board size, and CEO duality. The independence of the board indicates the number of outside directors on the company board. Board size refers to the number of directors, including both inside and outside directors. Finally, CEO duality exists when the company's CEO assumes both CEO and chairman board of directors' roles. Previous literature indicated different outcomes of board composition on risk. Literature states that independent boards take more risk-averse decisions and less radical decisions and avoid managers' risk-taking behaviour. Board size also proved to impact insolvency risk as larger boards are considered more conservative as it requires more diverse opinions and therefore, more thought out decisions emerge. Simultaneously, research also suggests that large boards are slow in their approach as it takes more time to arrive at a consensus when more people are involved in decision making. Similarly, CEO duality is considered to be opposing agency theory. However, stewardship theory supports the unity of command as fruitful if an individual is more compassionate and goal-seeking. Life cycle theory advocates that organizations' financial needs vary according to the growth stages, and the implication of risk is also varied. It is basically due to organizations' growth potentials depending upon their size and assets in place. Detailed literature supporting the impact of corporate board structure and firm growth on insolvency risk, mediating role of leverage decisions, and the moderating role of asset tangibility is present in the following sections.

2.2 Related Theories

2.2.1 Agency Theory

The agency theory, rooted in economic theory, was revealed by Alchian & Demsetz (1972) and elucidated by Jensen & Meckling (1976) and finally evolved in its current shape by Myers (1977). Agency theory has been defined as the relationship between shareholders and management or between agents and principals. Theoretically, the shareholders who own the business hire agents to do business. Two factors can influence the popularity of agency theory. First, the theory is a conceptual and straightforward theory that reduces society to two participants, i.e., shareholders and managers. Second, the agency's theory suggests that employees or managers of organizations might look for their interests. Shareholders in agency theory expect agents to act on behalf of the principal and make decisions. On the contrary, an agent cannot necessarily decide the best interests of the directors. In theory, an agent can be deprived of pursuing his interests and opportunistic behaviour rather than cohesion between the manager's desires and the principal's needs. Despite these failures, the agency's theory was widely presented as a division of ownership and control. Instead of paying incentives and bonuses, it is assumed that agents will focus only on stable and high-income salary projects with no incentive component. Although this provides a fair assessment, it does not eliminate or minimize business violations. Here, the positivist approach is used in places where agents are governed by the principal's rules to maximize shareholder value. Therefore, this theory applies a more personal opinion. Indeed, agency theory can be used to study the relationship between ownership and management. However, in case of separation, an agency model can align the management objectives with those of the owners.

CHAPTER 3 CONCEPTUAL FRAMEWORK AND HYPOTHESIS DEVELOPMENT .............38

3.1 Conceptual Framework of the Study .................................. 38

3.2 Hypothesis Development .................................................. 40

CHAPTER 4 DATA AND METHODOLOGY ........................... 57

4.1 Data Sources and Sample Description ................................... 57

4.2Data Analysis Approaches ................................................ 59

CHAPTER 5 PRELIMINARY RESULTS ..........................75

5.1 Preliminary Tests for Data Diagnosis ................75

5.2 Results for Descriptive Statistics .................75

CHAPTER 8 DISCUSSION ON RESULTS

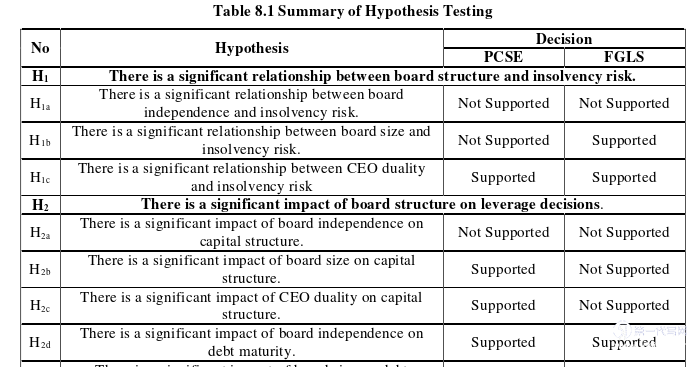

8.1 Influence of Board Structure on Leverage Decisions and Insolvency Risk

An independent corporate board structure is important in decision making because it influences a firms solvency position. Majority of past researchers prove the validity of agency theory while discussing the impact of board characteristics on insolvency risk. Researchers like Elamer, AlHares, Ntim & Benyazid (2018) claim that an independent board should restrain the insolvency risk. As depicted in table 8.1 the board independence has insignificant impact on insolvency risk thus unapproving our hypothesis on the relationship between board independence and insolvency risk. Our evidence is on the contrary, we found an inverse impact of board independence on emerging market Z score. It reflects that higher the number of independent or non-executive directors involved higher will be the insolvency risk. There is past evidence although scarce that supports this inverse relationship (Yasser, Al Mamun, & Seamer, 2017). These studies justify their results based on the ‘non-interested or least interested’ behavior of board members. Independent board members usually do not have their personal stakes in firm operations and therefore they do not care much about the adverse outcomes of their decisions. Normally in Pakistani context, board members are hired on personal relationships of existing management and they are not impartial in true sense. They attend boards to oblige their relations instead of acting as unbiased decision makers. Similar evidence is proved regarding the direct impact of board independence on insolvency risk in this research.

CHAPTER 9 CONCLUSION AND POLICY RECOMMENDATIONS

9.1 Conclusion

This study seeks to examine the effects of corporate board structure and firm growth on insolvency risk of non-financial listed firms of Pakistan. Moreover, this research claims that this effect is indirect in nature. Insolvency risk means inability of firms to pay their short term and long term obliagtions which emerge due to inefficient loan aquistion practices of corporate entities. So, it is concluded that the linkage between corporate board structure and insolvency risk and between firm growth and insolvency risk is mediated by the leverage decisions made by the management and monitored by corporate boards as explained by the monitoring hypothesis often discussed in the context of agency theory.

The firm growth-insolvency risk linkage through leverage decsions is also explored in the light of life cycle theory. Leverage decisions discussed here consist of capital structure decisions and debt maturity decisions. Further, based on information asymmetry theory the firms with large value of potential fixed collaterals have edge over their counterpart businesses. Hence, the moderating role of potential fixed collaterals is elaborated on the relationship between leverage decisions and insolvency. This research included five year’s data from 2013 to 2017 of 284 firms and used STATA 15.0 for analysis part. The multiple hierarchical regression with PCSE and FGLS estimators are employed to study the proposed relationship according to the study objectives.

reference(omitted)