本文是一篇人力资源管理论文,由于该研究填补了撒哈拉以南非洲地区员工激励方面的巨大研究空白,因此该研究具有实践和科学意义。作者打算在几个国家进一步开展这项研究。对于人力资源经理来说,这些发现为重新评估银行的激励方案提供了机会。对于研究界来说,这些发现为未来的实验和专家讨论提出了其他研究问题。

1 INTRODUCTION TO THE STUDY

1.1 Background to the Study

In this past decade, the sole aim of every organization has been sustainable growth. This has paved the way for an increased level of competition amongst organizations. Currently, in this competitive corporate environment, every organization, regardless of its size and market, is striving to gain an advantage over the others. However, this is only attainable by organizations that make effective, efficient, dynamic use of available resources to enhance their performance. Amongst the factors of production (land, human, capital, skills), human capital is the most demanding and important as it requires tactful handling of the thoughts and emotions of employees [1]. Employee motivation plays a great role in handling this challenge of gaining an advantage over other firms. According to [2], human resource is the wealth of an organization. Organizations that consider their human resource as a central core of the organization and continuously motivate and enhance the performance of their employees tend to be more effective [3, 4]. In using human labour, it is not enough to rely only on the number of employees engaged, their skills, knowledge, abilities (SKA’s), experience, qualification, but also ensuring that they are remunerated appropriately, as this is of paramount importance. A motivated employee can be described as a venture’s significant asset. Ghayyur et al. [5] revealed that motivation has a direct link with an individual’s performance. Motivation refers to the unseen force that orders energize, and sustains the behavior of a person [6-8]. It can, therefore, be viewed as a person’s state of mind or energy, which is later translated into action[9]. In simple terms, this action could be termed “performance”.

Highly motivated employees are known for their outstanding performance, hence, resulting in a more productive and effective organizational performance [10]. A highly motivated person will work hard towards the achievement of an organizational goal, given the ability and adequate understanding of the job. The challenge for today’s management has been how to administer motivational programs that stimulate employees to improve their work performance and productivity. Consequently, modern-day managers of financial services are adopting various kinds of motivational packages not only to retain employees but also to help them to achieve a competitive advantage in the market.

1.2 Problem Statement

In general, employee motivation is critical to the success of every organization. Failure to motivate employees will have drastic impacts on the organization. Motivation has been researched in many developed countries but not much in developing countries like Ghana, hence this study is important.

The need to ensure business continuity by increasing performance and efficiency in the workplace has heightened academic interest in the area of motivation. Researchers have shown keen interest in identifying the factors responsible for stimulating the will to work [14-16]. However, most organizations of today are still adopting former ways of motivating employees. Jishi[17] views motivated employees as staff retention and company loyalty, which later gives rise to the growth and development of a business. In modern times, people seek to be employed in places where they are well motivated. Therefore, firms must take a critical look at how they motivate their employees since employees form the backbone of every organization and their performance plays a vital role in the attainment of organizational goals.

Banks are one of the major and fundamental industries in any country and hence the need to be properly managed. However, the banking industry of Ghana has faced an upsurge in labor turnover because of the poor motivation of the employees leading to the underperformance of the banks[18]. Ghanaian commercial banks are battling with the challenge of increased competition, increased government regulations, and a high rate of technological advancement. Employees on the other hand are faced with the issue of feeling demotivated and overworked [19]. Conventionally, to enhance the performance of workers, some managers employ the use of promotion opportunities and monetary benefits [20]. However, there is a reason for apathy on the part of workers in banks [21]. Employees are dissatisfied with their work, paving way for low staff turnover, poor attitudes towards work as well as low output levels [22]. Factors like long working hours, high workload, and inadequate appreciation are reasons for the underperformance of workers. It is in light of this that this study seeks to examine the impact of motivation on employee performance.

2 LITERATURE REVIEW

2.1 Introduction to the Review

This literature review comprises nine (9) sections. It reviews both past and recently published articles related to the problem under study. Specifically, theoretical background, motivation, forms and theories of motivations, employee performance, measurement of employee performance, motivation and employee performance, motivation and business productivity, conceptual framework, and overview of the banking industry and commercial banks in Ghana.

2.2 Theoretical Background

The majority of the existing literature on motivation has broadened individual understanding of how to conceptualize the topic, although there have been some conflicting empirical findings. According to Kamali et al. [23], the writings of Greek Philosophers have been unearthed as the origination for the study on motivation. In contemporary management, motivation is classified into two namely intrinsic or extrinsic [24]. From the perspective of others, the effective way to attain work motivation depends on critical analysis and distinction between extrinsic and intrinsic rewards. Intrinsic rewards include a feeling of achievement, individual growth, and having self-esteem, whereas extrinsic rewards include a good working environment coupled with job security and other monetary benefits [25].

According to Irons and Buskist [26], educators view intrinsic motivators as more desirable and result-oriented compared to extrinsic motivators. Rai [27] purports that early approaches to motivational studies are grounded in extrinsic reinforcement and all behavior including achievement were by-products of reinforcement contingencies. Researchers ought to devote efforts to developing a standard theory of motivation [28]. Badubi[29] grouped the theories of motivation into three namely need theory (Maslow Hierarchy of Needs, Herzberg’s motivators and hygiene factors, Alderfer’s ERG theory), Cognitive theory (Expectancy theory, Equity theory), and reinforcement theory. 3 RESEARCH METHODOLOGY .............................................. 25

3.1 Introduction to the Methodology ............................................ 25

3.2 Research Design ..................................... 25

4 DATA ANALYSIS, FINDINGS, AND DISCUSSIONS ................................... 34

4.1 Introduction ................................... 34

4.2 Socio-demographic Characteristics of Respondents .................. 34

5 RECOMMENDATIONS AND FUTURE RESEARCH ................................... 50

5.1 Summary of Findings ................................. 50

5.1.1 State of Employee Motivation in Commercial Banks in Ghana ..................... 50

5.1.2 Factors that motivate employees of commercial banks .................................. 50

5 RECOMMENDATIONS AND FUTURE RESEARCH

5.1 Summary of Findings

The study was conducted to assess the impact of motivation on employee performance among commercial banks in Ghana. The summary of findings is thus, found below.

5.1.1 State of Employee Motivation in Commercial Banks in Ghana

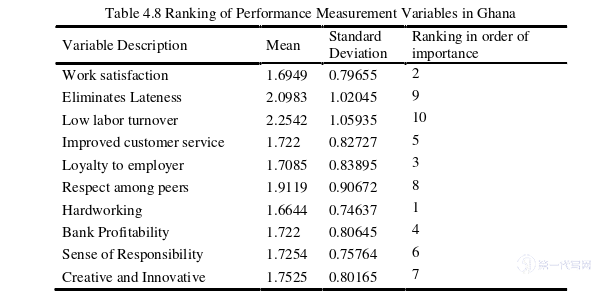

The ranking of motivational packages from highly prevalent to the least amongst commercial banks in Ghana are in the following descending order: employee loan scheme, recognition from others, empowerment to work, job security and good working environment, an opportunity for growth and development, monetary and fringe benefits, and flexibility on job design and promotions. Employees of commercial banks in Ghana rate the level of motivation at their bank as positive. The majority of employees also showed satisfaction with motivation at their workplace, although a few showed dissatisfaction. Regarding how often employees received motivational packages or the frequency of changes, they indicated, monthly, quarterly, bi-annually, or annually. Packages are changed often (about 65% of response).

Employees voiced an inequality in the distribution of motivational packages. According to Salem [53], equity in the workplace motivates employees to work better. Responses from the various banks indicated that most banks do not equitably motivate their employees. Consequently, apathy can arise towards work.

CONCLUSION

Every employee has job requirements and remuneration expectations from the organization. The human resource managers of these organizations must understand how their employees perceive their motivations and what they expect regarding motivation beyond money or salary. The banking sector is one of the most strenuous industries. Bank employees leave home early and return home late. This study gives findings that link motivation to performance in the context of Ghana.

The findings show that employees of the selected commercial banks are not only concerned by the monetary benefit, but also the work environment and pro-social policies from their employers. The study shows a strong relationship between motivation and performance as shown in extant literature. One critical concern voiced out by the employees is an uneven distribution of motivational packages. This requires practical measures depending on the setting of the companies. Organizations that consider their human resource as a central core of the organization and continuously motivate and enhance the performance of their employees, tend to be more effective. Highly motivated employees are known for their great work performance, hence resulting in a more productive and effective organizational performance.

This study is practically and scientifically relevant because of the huge research gap it fills in employee motivation in sub-Saharan Africa. The author intends to develop the study further in several countries. To the human resource managers, the findings present opportunities to reassess the motivational packages in banks. For the research community, the findings present other research questions for future experimentation and expert discussions.

reference(omitted)